Interest Rates and how they will affect Buying Power

If you are a home owner in this Denver Market you have likely experienced some equity growth in your property. It has been a wild real estate market in Denver and throughout the country as homes have appreciated in double digit values. After the housing market crash in 2009 the Federal Reserve (Fed) had dropped interest rates to unprecedented rates and the government created first time buyer incentive programs to go along with quantitative easing (printing money). When the economy is in a recession the Fed usually drops interest rates. This allows family’s to buy homes with lower monthly payments and businesses to barrow for much less which stimulates spending and boosts economic growth. But what happens when the economy is booming and home values are getting to be overinflated? They will begin to raise rates and will work on this never ending balancing game of heating up and cooling off the economy.

This is what we are beginning to see today, higher home values that are beginning to push first time buyers out of the market. Not to mention the stock market reaching all-time highs daily. These are key observations and tell tail signs that interest rates are on the rise. The Fed has promised a number of rate hikes for 2017 and they will likely rise into 2018.

The Good

There is some good news for buyers if interest rates are on the rise. If interest rates rise significantly over the next few year’s home values may drop allowing you to get into the game you have been wanting to get into. This could give you an opportunity to tap into some equity and start to build personal wealth by owning property. We believe if interest rates rise like they are supposed to, it should cool things down or at least stabilize prices.

The Bad and the Ugly

What if interest rates Rise and home values rise? This is a possibility that could leave you out of the game for years to come or push you into a lower purchase price option. It is difficult to speculate what will happen in any market. Denver has recently turned into a very popular place for Millennials and even Baby Boomers to move to.

If Rates Rise and Prices Stabilize

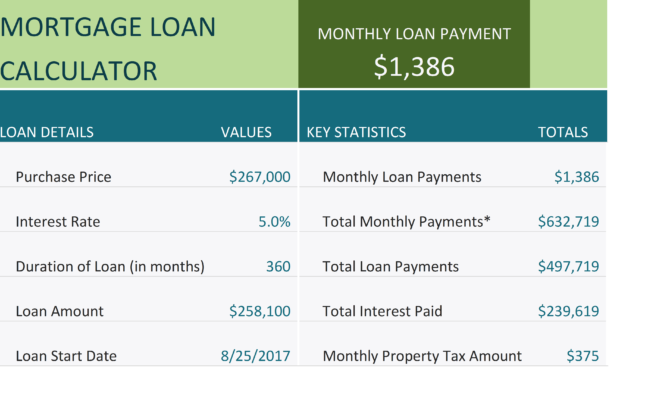

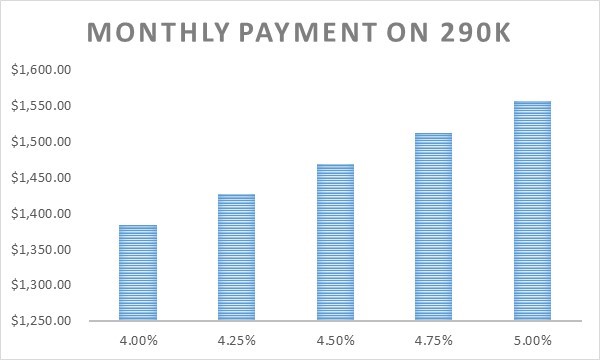

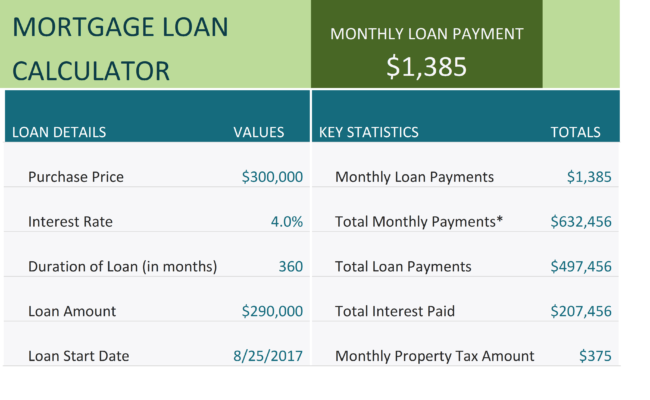

Let’s look at a few mortgage loan scenarios. This scenario we will assume home values go unchanged from 2017-2018. Figure 1.1 shows 2017, a $300,000 home $10,000 down at 4%. Figure 1.2 shows 2018 a $300,000 home $10,000 down at 5%.

Figure 1.1 shows you at a 4% interest rate your average monthly payment would be $1,385.

Figure 1.2 shows you at a 5% interest rate your average monthly payment would be $1,557.

Now you can see where it could get ugly. If prices level off which is what the Fed will likely try to do, you will be paying $165 more per month for the same house. This scenario shows that a 1% interest rate increase will cost you 11% on your monthly payment.

If this is what happens you will likely be priced out of the $300,000 home. When you are approved for a loan they look at what monthly payment you can afford. If your income stays the same and your Debt to Income Ratio does not change from 2017-2018 you are stuck with being approved for a monthly payment of $1,385. What does this mean in 2018 when the interest rate is 5%? This means you can’t afford the house you really wanted and now you must look for a different one that is $267,000 (see Figure 1.3 2018 $267,000 Home).

Figure 1.1

Figure 1.2

Figure 1.3